There might be restrictions to your level of cheques you could potentially put per day, few days otherwise week. These constraints will likely be according to the form of account, your put record, just how long the newest account could have been unlock or other things with your own banking relationship. Whenever submitting a cheque to possess cellular deposit, you’ll have to endorse they by finalizing the name. Banking laws need this information and, without it, your own mobile cheque deposit could be refused. Together with her, such steps will help improve security while using the your own smart phone in order to put cheques, opinion your own balance otherwise manage almost every other online banking issues.

- Bettors looking simplicity is also perform the betting and their cellular telephone statement having one percentage, one other reason for the means increasing in popularity.

- Contain otherwise change your lead deposit information to possess Virtual assistant disability compensation, retirement professionals, or degree pros on the internet.

- Before leaving the site, we need one to know the software shop has its own privacy methods and you can number of defense which may be not the same as ours, thus excite opinion its formula.

- You could deposit money using a credit, an automatic teller machine Put Password otherwise making use of your membership information or via QR Cardless in the CommBank Application.

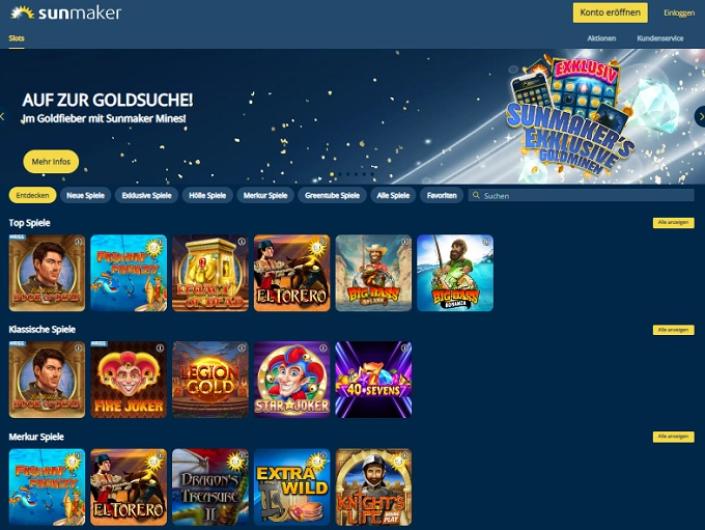

Wild games slot: Exactly how we Get the best Spend by Mobile phone Casinos within the Southern area Africa

View 21 was designed to foster invention on the payments system andto improve their results by reducing some of the judge impediments tocheck truncation. A replacement take a look at ‘s the legalequivalent of one’s brand-new view and includes all the informationcontained to your brand-new take a look at. Legislation doesn’t need banking institutions toaccept monitors inside electronic function nor does it require banking companies to make use of thenew expert offered because of the the newest Operate to make alternative checks. Make sure you are having fun with an official application from your own economic institution to deposit a cheque digitally.

The new Bankrate hope

Fake cellular apps accounted for nearly 40 per cent of all of the con symptoms inside 2021, according to a research from the Outseer, a supplier away from percentage fraud shelter services. Banking companies usually give website links on the other sites to have properly downloading the applications. There are lots of causes you could potentially make use of your bank’s mobile cheque put function, starting with benefits. Deposit cheques with your smart phone may be much more accessible and less time-ingesting than operating to help you a department otherwise Atm. And in case your lender with an online-simply lender no bodily branches, cellular look at put can be reduced than emailing inside an excellent cheque.

Placing currency otherwise cashing a check familiar with involve a trip for the financial, which is each other wild games slot time consuming and inconvenient. But cellular look at deposit have eliminated those frustrations, to make of numerous financial purchases as simple as bringing a photo, any moment of date. Cellular look at put spends secluded put take tech to help you put the brand new consider money into the savings account. Which unit allows banking institutions take on dumps using digital photographs of one’s back and front away from a check unlike demanding the initial report take a look at becoming personally placed during the a branch or Atm. Regardless of the sort of your own smart phone, you can use Spend from the Cellular phone characteristics to cover their local casino membership. The process is straightforward as well as the most sensible thing about it is which you wear’t must disclose their credit card or financial info.

Deposit The Inspections the simple Method

The fresh ConnectNetwork website and you can mobile software accept big playing cards (Charge and you can Bank card) and enable deals 24 hours a day, 7 days a week, 365 months a-year. On line banks is actually enhanced for on the web purchases, very electronic transfers plus mobile consider deposits are a great breeze. That’s not true which have cash, however, it is possible to ultimately hide your bank account to your an on the internet membership. It could take a little effort, nonetheless it was beneficial the very next time a good wad from expenses comes your path. Pay because of the cellular casinos are also perfect for individuals who don’t get access to a bank account otherwise mastercard, or you don’t want to use the individuals tips for individual factors.

Whilst you won’t be charged a payment for people put deals, your chosen casino may charge a control fee. While the charges claimed’t come from your own mobile user, it’s value examining together with your local casino regarding their charge and you may terms. Reload now offers are merely open to coming back players who’ve in the past financed the on-line casino membership. They show up throughout various other shapes and forms, such as matches incentives, 100 percent free spins, respect rewards, and so on. But basically, they rewards your with some sort of casino borrowing to use for the online game.

- Since the devices and you may mobile sites are so commonplace, they supply a replacement banking services.

- Including tax refunds and you may stimulus cheques, such as those awared in the COVID-19 pandemic.

- When you’re picking a top Shell out by Cellular phone local casino, there are some things that you need to think when signing up.

- Endorsing a check and you will to make a cellular consider deposit is actually relatively simple steps.

- Of several banks give mobile financial, electronic wallet repayments, peer-to-fellow payments, and.

- It’s a casino enabling one to generate places having fun with their cell phone number.

Put inspections to the Funding You to bank account away from mostly anyplace.

For those who’re also maybe not attracted to accumulating a huge mobile phone expenses and will not want the brand new urge of extra cash you could potentially’t afford, choose wire transfers as an alternative. You won’t just just be able to put money which you already have on your own Southern African bank account, you could as well as come across wire transfer since your withdrawal means after you’re also willing to cash out. It’s as well as one of several quickest and you will trusted percentage procedures offered. We’re also not shocked because of the rapid boost in the number of South African online casinos providing spend because of the mobile phone since the a payment choice. Our professionals has recognized shelter as being the first reasoning it’s got proven very popular certainly participants.

What is mobile take a look at deposit and and that financial institutions offer it?

The most used reason their cellular consider deposit isn’t functioning is simply because your forgot so you can signal the rear of their view. Before taking a picture, make sure you’lso are always endorsing their look at. In that way you wear’t have to go back and start the procedure once again. You’ve probably viewed an electronic Handbag doing his thing, or feel the app on your own cellular phone, however, do you have the skills to use it?